Analysts recorded the restoration of the influx of funds on crypto funds

Analysts recorded the restoration of the influx of funds on crypto funds

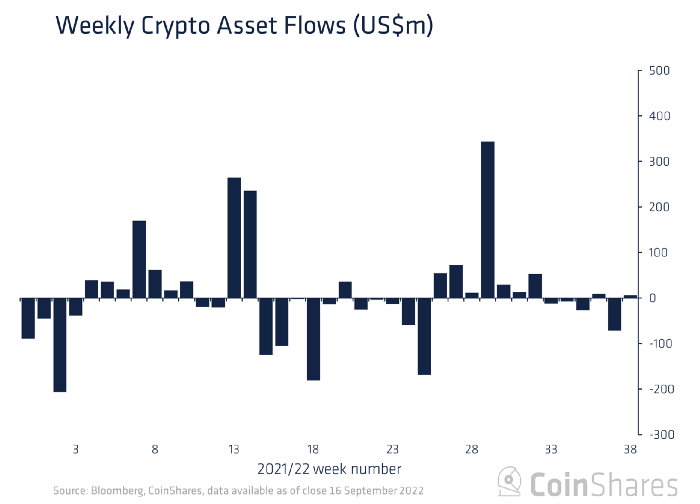

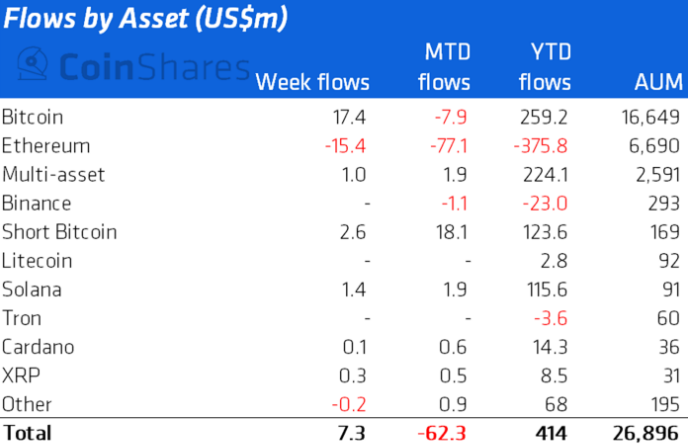

The influx of funds in cryptocurrency investment products from September 10 to 16 amounted to $ 7.3 million against an outflow of $ 63 million a week earlier. Such grades were cited by CoinShares analysts.

"A combination of positive and negative flows […] speaks of the preserved lack of involvement among investors", – reported analysts.

In traditional bitcoin BTCUSD course forecast funds, an influx of $ 17 million was observed. Before that, negative dynamics was recorded for five weeks in a row ($ 93 million in total for this period).

The structures that allow you to open shorts for the first cryptocurrency have received $ 2.6 million. CoinShares запустила Their Aum approached the record $ 169 million.

The outflow of Ethereum funds continued for a fourth week in a row ($ 15.4 million against $ 61.6 million weeks earlier).

There were no significant changes in products based on other altcoins.

Cryptoactive basket funds attracted $ 1 million. Since the beginning of the year, admission to these products ($ 224.1 million) have been almost equivalent to tributaries on bitcoin funds ($ 259.2 million).

Recall, on September 19, the quotes of the first cryptocurrency could not resist the marks above $ 19,000.

Previously ex-controlled Cramer hedge fund & Co. And the host of the Mad Money show on the CNBC channel Jim Kramer said that the fragmentation of the Federal Council will lead to “leaching” of speculative assets like cryptocurrencies.

Read the FORKLOG Bitcoin News in our Telegram-cryptocurrency news, courses and analytics.